It's time for the latest NENA E-News!

Your source for news, resources, and advocacy

for your Employment Network (EN).

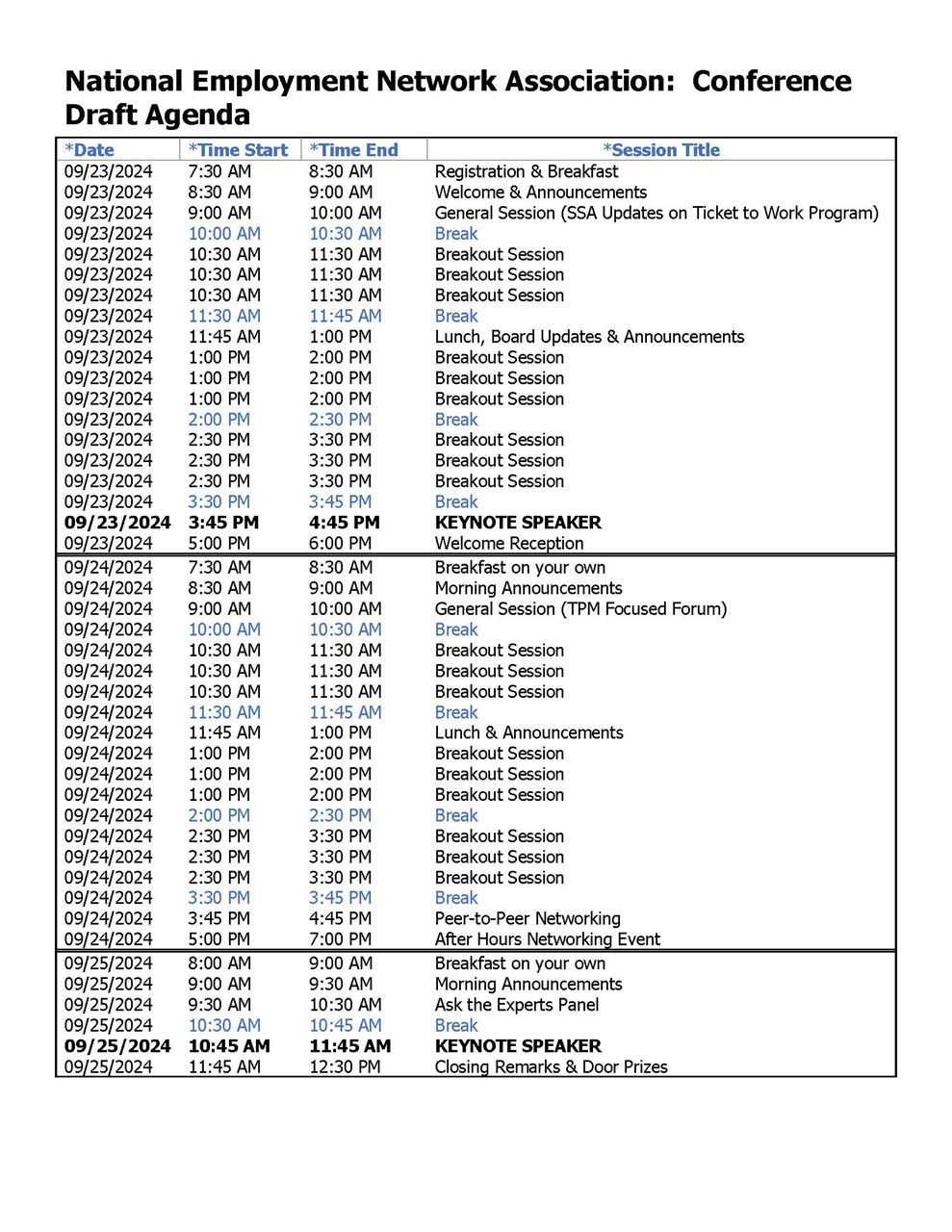

Conference Update

|

Tentative Conference Agenda available! (Click to enlarge)

![]() Member Tip:

Member Tip:

Do you find yourself searching for Zoom links right before a NENA call? All links to member calls can be found in the member section of the NENA website on THIS PAGE

Bookmark it and you'll never be caught without the log-in credentials again!

News to Know

March 20, 2024

Social Security Announces Four Key Updates to Address Improper Payments

Social Security Commissioner Martin O’Malley today announced he is taking four vital steps to immediately address overpayment issues customers and the agency have experienced. Commissioner O’Malley testified before the U.S. Senate Special Committee on Aging and the U.S. Senate Committee on Finance (excerpt):

“For 88 years, the hard-working employees of the Social Security Administration have strived to pay the right amount, to the right person, at the right time. And the agency has done this with a high degree of accuracy over a massive scale of beneficiaries. But despite our best efforts, we sometimes get it wrong and pay beneficiaries more than they are due, creating an overpayment.

When that happens, Congress requires that we make every effort to recover those overpaid benefits. But doing so without regard to the larger purpose of the program can result in grave injustices to individuals, as we see from the stories of people losing their homes or being put in dire financial straits when they suddenly see their benefits cut off to recover a decades-old overpayment, or disability beneficiaries attempting to work and finding their efforts rewarded with large overpayments. Innocent people can be badly hurt. And these injustices shock our shared sense of equity and good conscience as Americans.

We are continually improving how we serve the millions of people who depend on our programs, although we have room for improvement, as media reports last fall revealed. We have also embarked upon a deep dive into the extent of the overpayment problem at Social Security, the root causes of these administrative errors, and the steps we can take as an agency to address these individual injustices.

Our deeper understanding of the complexities of this problem has set us on the following course of action:

- Starting next Monday, March 25, we will be ceasing the heavy-handed practice of intercepting 100 percent of an overpaid beneficiary’s monthly Social Security benefit by default if they fail to respond to our demand for repayment. Moving forward, we will now use a much more reasonable default withholding rate of 10 percent of monthly benefits — similar to the current rate in the Supplemental Security Income (SSI) program.

- We will be reframing our guidance and procedures so that the burden of proof shifts away from the claimant in determining whether there is any evidence that the claimant was at fault in causing the overpayment.

- For the vast majority of beneficiaries who request to work out a repayment plan, we recently changed our policy so that we will approve repayment plans of up to 60 months. To qualify, Social Security beneficiaries would only need to provide a verbal summary of their income, resources, and expenses, and recipients of the means-tested SSI program would not need to provide even this summary. This change extended this easier repayment option by an additional two years (from 36 to 60 months).

- And finally, we will be making it much easier for overpaid beneficiaries to request a waiver of repayment, in the event they believe themselves to have been without any fault and/or without the ability to repay.

Implementing these policy changes — with proper education and training across the people, policies, and systems of the agency — is an important but complex shift. And we are undertaking that shift with urgency, diligence, and speed.

I look forward to working with Members to discuss ideas that could address the root causes of overpayments.”

Social Security launched a comprehensive review in October 2023 of agency overpayment policies and procedures to address payment accuracy systematically. (See Learn about Overpayments and Our Process | SSA and Press Release | Press Office | SSA). These changes are a direct result of the ongoing review. Additionally, the agency recently announced it is working to reduce wage-related improper payments by using its legal authority to establish information exchanges with payroll data providers that will significantly reduce the number of improper payments, once implemented. (See Press Release | Press Office | SSA for more information). The agency will continue examining programmatic policy and making regulatory and sub-regulatory changes to improve the overpayment process. More details on these updates will be shared as they become available.

To watch the testimony and read Commissioner O’Malley Statement for the Record, visit Keeping Our Promise to Older Adults and ... | Senate Committee On Aging and Hearing | Hearings | The United States Senate Committee on Finance.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

March 18, 2024 GovDelivery Message: TPA Section 8 Clarification/ Reminder This reminder summarizes the Social Security Administration's (SSA) policy and procedures on protecting and reporting the loss, compromise, or potential compromise of Personally Identifiable Information (PII) to ensure Employment Networks (EN) follow them and share incident information appropriately. ENs must establish and abide by their own policy and procedures to protect PII. In addition, ENs are responsible for implementing SSA’s prescribed procedures for reporting lost, compromised, or potentially compromised PII outlined in Part IV, Section 8.C.3 of the Ticket Program Agreement (TPA). ENs must educate their employees, subcontractors, and/or provider affiliates who handle PII on protecting and reporting the loss, compromise, or potential compromise of PII, as well as enforce their compliance with these policies and procedures. The following is an outline of the Agency-prescribed procedures for reporting all suspected or confirmed incidents involving PII: 1. When an EN employee, including a subcontractor or provider affiliate employee, becomes aware or suspects that PII has been lost, compromised, or potentially compromised, the EN must notify SSA’s National Network Service Center (NNSC) by phone at 1-877-697-4889 and the primary SSA contact at ENService@ssa.gov within one hour of the incident. 2. The EN should use the Worksheet for Reporting the Loss, Compromise, or Potential Compromise of PII to quickly gather and organize information about the incident. The worksheet identifies the information to report to the primary SSA contact and the NNSC. 3. The initial report to the primary SSA contact should be by email with “PII Breach” and the EN's Provider Identification (PID) number in the subject line. It should also include the following information:

4. The initial report to the NNSC should be by phone. When reporting the loss, compromise, or potential compromise of PII to the NNSC, the agent will provide the EN one or more ticket numbers and will send at least one email. The EN must retain the ticket number(s) and email(s) and provide them to SSA upon request. 5. In the event of PII loss, compromise, or potential compromise, the EN must take immediate action to address consequential security issues identified, including actions to minimize further security risks. NOTE: ENs bear the responsibility and cost for any data breach and/or remediation actions that might arise from the security and/or PII loss incident, including notifying affected individuals of the security breach, if required by SSA. Unless authorized by SSA, ENs are prohibited from retaining the services of a data recovery, loss mitigation, or related company to attempt to recover the lost or compromised data. 6. The EN must provide the appropriate SSA contact updates on the status of the reported PII loss or compromise as they become available, including the actions the EN has taken and plans to take in dealing with the incident. Please contact ENService@ssa.gov with any questions concerning protecting and reporting the loss, compromise, or potential compromise of PII. March 14, 2024 The Ticket Program Manager (TPM) has developed the following resources for ENs to use when submitting Individual Work Plans (IWP) and requests for Ticket unassignment: IWP Submission Coversheet TPM often receives IWPs with no submission reason identified, which delays IWP review and/or Ticket assignment. To streamline the submission process and ensure that appropriate Program Integrity staff receive the IWP, TPM developed the IWP Submission Coversheet. ENs should use this coversheet to provide the necessary information and identify the reason for submitting the IWP. We ask that ENs submit IWPs with the IWP Submission Coversheet via Government-to-Government Services Online (GSO) or, if unable to submit via GSO, please fax to 1-703-893-4020. Ticket Unassignment Request Template In most cases, ENs can unassign Tickets via the Ticket Portal. However, there may be instances in which the EN must reach out to TPM for Ticket unassignment (for example, the EN doesn’t have access to unassign Tickets in the Ticket Portal). The EN Unassignment Request Template outlines the information TPM needs to process a Ticket unassignment request. ENs may use the EN Unassignment Request Template to unassign a Ticket, although SSA will accept other formats, assuming the necessary information is included. ENs should submit Ticket unassignment requests via GSO or, if they are unable to submit via GSO, via fax. For EN convenience, we have attached a copy of the IWP Submission Coversheet and EN Ticket Unassignment Request Template to this message. They are also both available on the Your Ticket to Work website under Resources and Resource Documents. Please contact Program Integrity at Programintegrity@yourtickettowork.ssa.gov for questions or assistance. March 6, 2024 The Social Security Administration (SSA) provides routine reminders to Employment Networks (EN) regarding Personally Identifiable Information (PII) in accordance with your Ticket Program Agreement, Part III Section 8.E. SSA’s policy regarding an EN’s transmission of PII to SSA and Ticket Program Manager (TPM) states:

SSA will enforce the following consequences against ENs that transmit PII through email to the agency or to TPM: First Violation

Second Violation

Third Violation

If an EN has questions about a payment request, the EN must use any of the methods noted below:

TPM will route all faxes and mail to the correct department. Please allow extra time for processing. Best practices for faxing or mailing PII to TPM:

Please contact ENservice@ssa.gov with any questions concerning the use of electronic systems for transmitting PII. |

February 15, 2024 SSA Proposes Rule to Curb SSDI and SSI Payment Errors On February 15, 2024, SSA introduced a rule targeting improper payments in SSDI and SSI programs by leveraging electronic payroll data. Commissioner O'Malley highlighted the importance of timely wage data in reducing overpayments through systems like the Payroll Information Exchange (PIE). Stakeholders are encouraged to participate in the public review and comment period until April 15, 2024. For further information, refer to the notice of proposed rulemaking (NPRM) here. |

Do you know what the NENA mission is? It is now prominently featured on our homepage! |

|

Stay Connected

| Add the following Upcoming Events to your calendar: |

Bulletin Board

Work Incentives Training Interested in learning more about Work Incentives Planning? Opportunities are available! | Help Wanted Job Board Does your member organization have an internal position available within your organization that you would like to post in the NENA E-News? As a member courtesy, we will post your opening in our next E-News update one time. Posting requirements: • The posting must be for a specific, EN-related position within your organization (i.e., career specialist, career services provider) • Email admin@nenaticket.org to submit your post • Include the title, location, a brief description (25 words) and contact information on the form. *Those interested in applying should contact the EN directly. NENA will have no further information about any posted positions. |